Debt Consultant Singapore: Professional Solutions for Financial Management

Wiki Article

Discover Just How Professional Financial Obligation Expert Providers Can Help You Gain Back Financial Stability and Handle Your Financial Debt Effectively

In today's complex financial landscape, numerous individuals locate themselves coming to grips with frustrating financial debt and uncertainty regarding their economic future. debt consultant singapore. Professional financial obligation expert solutions offer a structured technique to regaining stability, offering customized approaches and expert insights developed to attend to one-of-a-kind financial challenges. By leveraging their proficiency in settlement and financial debt monitoring, these professionals can create effective repayment plans that minimize anxiety. Nevertheless, recognizing the complete range of their benefits and how to pick the right specialist is important to achieving long-term financial health. This exploration reveals necessary factors to consider that can considerably affect your journey toward financial recovery.Understanding Financial Debt Expert Services

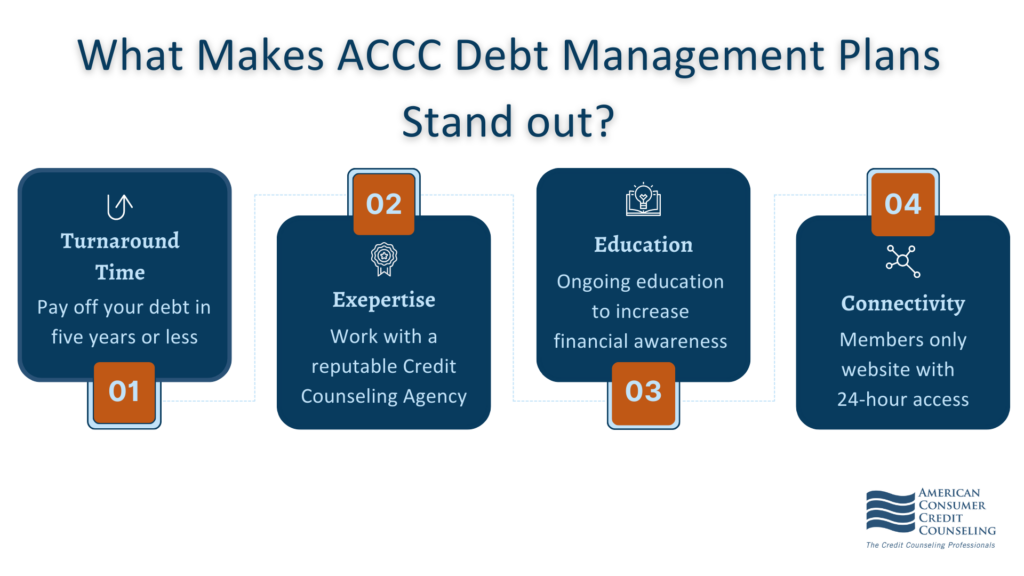

Financial debt expert services give individuals and businesses with specialist assistance in handling and solving monetary commitments. These services aim to help clients in browsing complex economic landscapes, providing customized techniques to resolve varying degrees of debt. A financial debt specialist commonly examines a customer's financial scenario, including earnings, expenses, and existing financial obligations, to create an extensive strategy that aligns with their distinct demands.Consultants utilize a selection of methodologies, such as budgeting help, financial debt combination choices, and arrangement with lenders - debt consultant singapore. By leveraging their expertise, they can help customers recognize the implications of their debt, including passion prices, repayment terms, and potential legal consequences. In addition, consultants typically inform customers concerning economic literacy, empowering them to make educated choices that can bring about long-term economic wellness

Furthermore, these services may involve creating structured repayment plans that are sustainable and manageable. By working together carefully with clients, financial obligation experts foster a supportive setting that encourages commitment to monetary self-control. In general, comprehending the scope and functions of debt consultant solutions is critical for services and individuals seeking effective solutions to their monetary challenges, inevitably leading the method to higher financial security.

Advantages of Expert Guidance

Specialist advice in financial obligation administration provides numerous benefits that can substantially enhance a person's or service's financial scenario. Among the primary advantages is access to expert expertise and experience. Financial obligation consultants have a deep understanding of different financial items, legal laws, and market conditions, allowing them to offer informed recommendations tailored to details situations.

Furthermore, debt experts can offer settlement skills that individuals could lack. They can connect efficiently with financial institutions, potentially safeguarding better repayment terms or reduced rate of interest prices. This advocacy can cause more positive end results than individuals might attain by themselves.

Tailored Approaches for Debt Administration

Reliable debt administration calls for greater than just a fundamental understanding of economic obligations; it demands methods customized to an individual's distinct scenarios. Everyone's financial situation is unique, affected by various elements such as earnings, costs, credit scores history, and individual objectives. Specialist financial debt professionals succeed in creating customized strategies that resolve these certain components.Through a comprehensive evaluation, consultants recognize one of the most important debts and analyze costs habits. They can then suggest effective budgeting techniques that straighten with one's way of life while prioritizing financial obligation repayment (debt consultant singapore). Furthermore, consultants might recommend consolidation methods or arrangement methods with creditors to lower rate of interest or establish manageable layaway plan

A significant advantage of customized methods is the versatility they supply. As conditions news transform-- such as work loss or increased expenses-- these techniques can be readjusted as necessary, making certain ongoing significance and efficiency. In addition, consultants provide ongoing assistance and education and learning, encouraging people to make educated decisions in the future.

Ultimately, customized financial debt monitoring methods not only promote immediate remedy for economic concerns yet also foster long-lasting economic stability, allowing people to regain control over their financial resources and attain their financial goals.

Just How to Pick a Specialist

How can one guarantee that they select the best debt specialist for their needs? Choosing a debt consultant requires mindful consideration of numerous crucial factors.Next, examine their reputation. Research on-line testimonials and endorsements to assess the experiences of past clients. A trusted specialist will usually have favorable comments and a record of effective financial debt administration outcomes.

It is additionally vital to comprehend their method to financial obligation management. Set up an examination to discuss their strategies and guarantee they align with your economic goals. Transparency relating to services and costs is crucial; a trustworthy expert ought to give a clear rundown of costs entailed.

Lastly, take into consideration the specialist's interaction style. Pick someone that pays attention to your responses and my sources problems your concerns plainly. A strong connection can cultivate a collective partnership, important for properly managing your financial obligation and attaining financial security.

Steps to Attain Financial Stability

Attaining financial security is a systematic procedure that involves a series of calculated steps customized to description individual scenarios. The very first step is to assess your present economic situation, consisting of revenue, financial obligations, assets, and expenses. This extensive examination provides a clear photo of where you stand and assists recognize locations for improvement.

Next, produce a sensible spending plan that focuses on important costs while designating funds for financial debt settlement and financial savings. Sticking to this budget is important for preserving monetary technique. Following this, discover financial debt monitoring alternatives, such as combination or settlement, to minimize rate of interest rates and regular monthly repayments.

Establish a reserve to cover unforeseen costs, which can avoid reliance on credit report and additional financial obligation build-up. Once immediate economic stress are resolved, concentrate on long-lasting financial goals, such as retired life financial savings or financial investment techniques.

Verdict

In final thought, professional financial obligation professional services use valuable sources for people seeking monetary security. By providing professional advice, tailored methods, and recurring support, these specialists promote effective financial obligation administration.In today's intricate financial landscape, numerous people locate themselves grappling with overwhelming debt and uncertainty regarding their economic future. Professional debt specialist solutions supply an organized approach to restoring stability, supplying customized approaches and expert insights developed to deal with special economic obstacles. A financial debt consultant usually examines a customer's monetary circumstance, consisting of earnings, expenses, and existing financial obligations, to develop a detailed strategy that straightens with their special demands.

Generally, comprehending the range and functions of debt specialist services is crucial for individuals and organizations seeking effective services to their financial obstacles, inevitably leading the method to greater economic security.

In final thought, expert debt professional solutions provide important sources for people seeking economic security.

Report this wiki page